Property Developers Taxpayer Alert TA 2026/1: When the ATO’s Anti-Avoidance Net Is Cast Too Wide

On 14 January 2026, the Australian Taxation Office (ATO) released Taxpayer Alert TA 2026/1, signalling heightened scrutiny of certain related-party property development arrangements. While framed as a response to “contrived” schemes, the alert has caused understandable concern across the property, construction and advisory sectors, not because it uncovers genuinely aggressive tax avoidance, but because it appears to blur the line between legitimate commercial structuring and impermissible tax behaviour.

Rather than clarifying the law, TA 2026/1 arguably introduces greater uncertainty into an already complex area of taxation, placing compliant taxpayers and advisers at risk of retrospective challenge simply for adopting widely-used, commercially rational development structures.

What the ATO Is Saying - In Broad Terms

The ATO’s core concern is that some property groups use related-party Property Development Agreements (PDAs) to:

Defer the recognition of development income, and

Claim deductions during the construction phase, often generating tax losses.

According to the ATO, where a special purpose developer entity is interposed between a landowner and a builder, and income is recognised later in the project lifecycle, this may indicate a dominant purpose of obtaining a tax benefit.

The difficulty is that this description captures a very large proportion of ordinary, commercial property developments, including arrangements long accepted by the market and advisers alike.

A Commercial Reality the ATO Appears to Overlook

In practice, separating landholding from development activity is not unusual, artificial, or inherently tax-driven. It is commonly done for:

Risk containment and asset protection

Project financing requirements

Joint venture flexibility

Investor participation and exit planning

Compliance with lender or investor mandates

Yet TA 2026/1 appears to treat this separation as suspicious by default, particularly where entities are related, despite the fact that related-party structures are a commercial necessity for most private groups.

The alert offers little acknowledgement that large-scale developments often span many years, and that income deferral during construction is frequently a natural consequence of commercial reality, NOT tax manipulation.

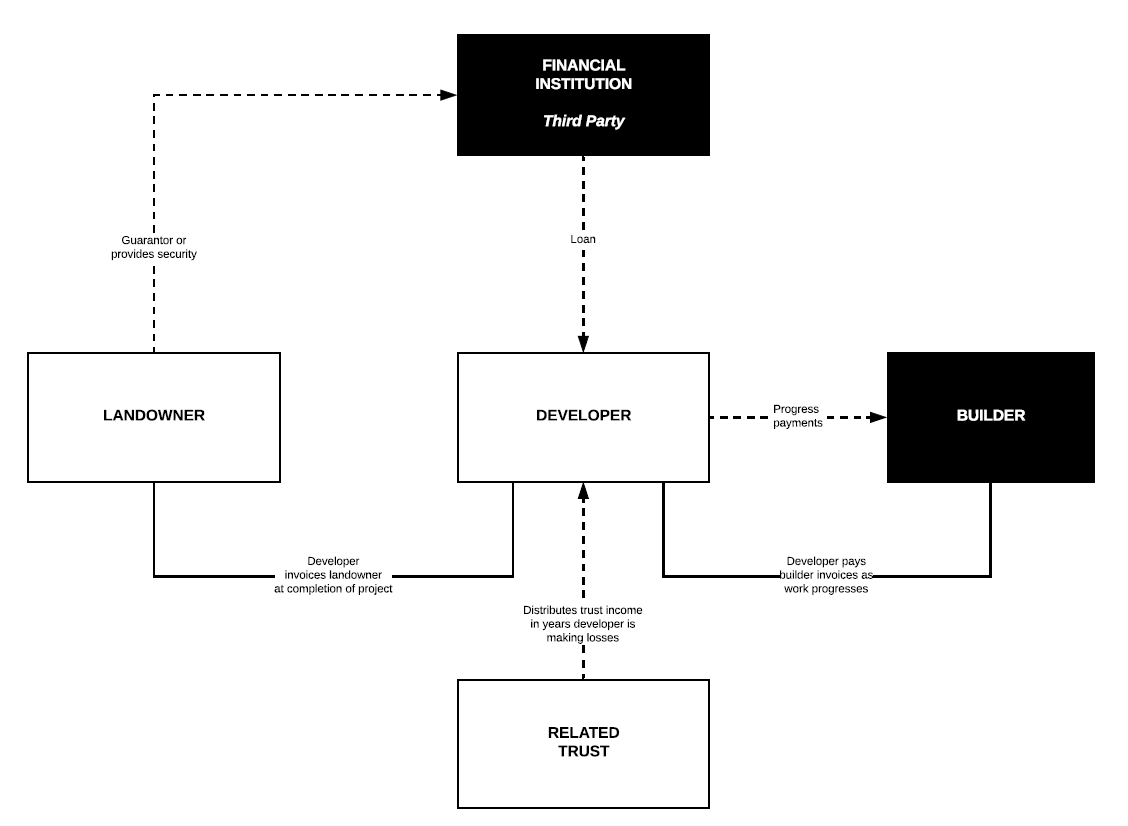

The ATO’s “Concerning” Structure - Illustrated

The ATO describes a structure broadly as shown here:

From the ATO’s perspective, this structure raises concerns because:

The developer claims deductions during construction

Income is recognised later (often at project completion)

Losses may be used elsewhere within the group

However, this analysis largely ignores the economic substance of property development, where profit is often genuinely uncertain until completion, sales, or settlement.

Timing Differences Are Not Automatically Avoidance

A key weakness in TA 2026/1 is its implicit assumption that timing mismatches between deductions and income are inherently problematic.

In reality:

Construction costs are incurred progressively and must be paid as work is done

Revenue may not be legally or practically derived until completion, sale, or settlement

Development risk (planning, market, cost overruns) remains live for years

The alert gives little weight to the fact that tax law has always recognised timing differences, particularly in long-term projects. Treating these differences as prima facie evidence of avoidance risks re-characterising ordinary business outcomes as tax schemes.

“Lack of Substance” - A Subjective and Dangerous Test

The ATO also criticises developer entities that have:

Few employees

Limited physical assets

Outsourced construction activities

But this criticism sits uncomfortably with modern commercial practice. Many legitimate development entities are capital-light, operating as project managers rather than builders.

Outsourcing construction does not make a developer a sham, it makes it commercially prudent.

By implying that such entities lack substance, the ATO risks substituting its own view of how a business should operate for how businesses actually operate.

Part IVA: The Ever-Present Threat

Perhaps most concerning is the ATO’s heavy reliance on Part IVA, Australia’s general anti-avoidance rule.

TA 2026/1 makes clear that where the ATO forms the view that a development structure has a dominant tax purpose, it may:

Cancel deductions

Accelerate income recognition

Impose penalties and interest

The problem is not Part IVA itself, but the breadth with which it is being signalled. Without clear boundaries, taxpayers are left guessing whether perfectly ordinary structuring decisions may later be recast as avoidance with the benefit of hindsight.

Compliance by Intimidation?

Taxpayer Alerts are meant to flag exceptional, clearly abusive behaviour. TA 2026/1 instead reads as a warning shot across an entire sector.

The ATO states it will issue a Practical Compliance Guideline (PCG), but until then, taxpayers are effectively told:

“We may not like your structure and we’ll let you know later whether that’s a problem.”

This approach risks chilling legitimate investment, discouraging development activity, and forcing taxpayers into overly conservative positions simply to manage regulatory risk.

What Should Taxpayers Do - Pragmatically

Despite the concerns with the alert, taxpayers cannot ignore it. Sensible steps include:

• Review Existing Structures

Ensure development arrangements are commercially documented, with clear roles, pricing, and risk allocation.

• Strengthen the Commercial Narrative

Be able to articulate why the structure exists beyond tax - financing, risk, governance and investor considerations matter.

• Avoid Aggressive Loss Recycling

Where losses are generated, be cautious about their use across unrelated group activities.

• Consider Early Engagement

Private rulings or pre-lodgement discussions may provide certainty - albeit at additional cost and effort.

Final Thoughts - Get the Right Advice Early

TA 2026/1 reflects a broader trend in which the ATO appears increasingly willing to challenge mainstream commercial property arrangements using expansive anti-avoidance arguments, rather than clear legislative rules.

While genuinely artificial schemes should be addressed, casting suspicion over widely accepted development structures, risks undermining certainty for property investors and developers, particularly in a sector where long project timeframes, complex financing and risk management are unavoidable commercial realities.

For now, taxpayers and advisers are left navigating a familiar tension: commercial reality on one side, and an increasingly expansive view of avoidance on the other.

In this environment, getting the structure right from the outset and being able to clearly articulate the commercial rationale, has never been more important.

If you are involved in a property development seeking early, specialist advice is critical. We are leading Brisbane property accountants, advising developers, investors and private groups on property structuring, tax risk management and ATO engagement. We understand both the commercial drivers of property development and the ATO’s current compliance focus, and we work proactively to protect our clients from unnecessary disputes, reassessments and penalties.

If you would like to discuss how this alert may affect your structure or want a second opinion on an existing arrangement we encourage you to get in touch.

As always, the above is general in nature, please discuss with your trusted advisor.